WEBINAR REPLAY: 2022 Open Enrollment Info

If you missed our 2022 Individual Health Insurance Open Enrollment webinar a video replay is available below.

If you missed our 2022 Individual Health Insurance Open Enrollment webinar a video replay is available below.

Once you have determined you need term life insurance, it’s time to choose a policy. Be aware that many policies differ on certain points, so you’ll want to ask a few important questions before purchasing a plan. The following questions can be answered by your agent or found within the information that has been provided to you concerning the policy.

Term life insurance policies last for a specific amount of time — most policies last for 10, 20, or 30 years. Your decision on which length of time to pick depends on why you need the life insurance in the first place. Some people purchase term life insurance just to make sure that short-term debts would be covered in the event of their death. Other people are looking to take care of long-term obligations such as paying off a mortgage or putting children through college. For these types of goals, a 20 or 30-year plan can be more beneficial. Insurance providers offer a variety of terms to help meet the individual needs of each client. This makes it easy to find a plan that fits your particular goals and needs.

All insurance policies will have exclusions or special circumstances that could affect your family’s ability to receive payments at the time of your death. Some exclusions can nullify your death benefits altogether. These exclusions will vary from carrier to carrier, so it is important to ask specifically which exclusions are included in the policy you are reviewing.

Some of the most common exclusions are suicide, dangerous hobbies or occupations, an aviation exclusion, and an act of war exclusion. Hobbies are one of the most varied types of exclusions, so make sure you check the details on this if you participate in any hobbies that could be deemed risky.

Because term life insurance policies are for a set period of time, most individuals who purchase them will live to see their expiration. If you think you may want to continue having life insurance coverage after it expires, you’ll want to review the options for continuing your coverage on the chosen policy with your agent. Certain term policies have a renewable or convertible benefit to make sure you can continue life insurance coverage in some form once it expires, even though you’re older and possibly in a different state of health than when you first bought your term policy.

Although your premium might seem affordable now, if your financial situation changes in the future it might be difficult to pay your premium. You should be aware of the consequences for missing payments on the policy in question. Each carrier will have different types of penalties for lapsed payments. You should only purchase a policy with consequences you can live with.

Purchasing term life insurance is a great way to help ensure your family’s financial security. Review term life plans available to you as a benefit of your membership.

While health insurance enrollment is typically only available during the annual Open Enrollment period at the end of the year (unless you have a qualifying life event), the 2021 American Rescue Plan Act (ARP) led to the creation of a Special Enrollment Period to assist Americans during the Covid-19 pandemic.

The 2021 Special Enrollment Period began on 2/15/21 and will close on 8/15/21.

As of June 30 more than 1.5 million people have enrolled in new health coverage since the Special Enrollment Period began, and another 2.5 million have been able to lower the premiums of their existing plans.

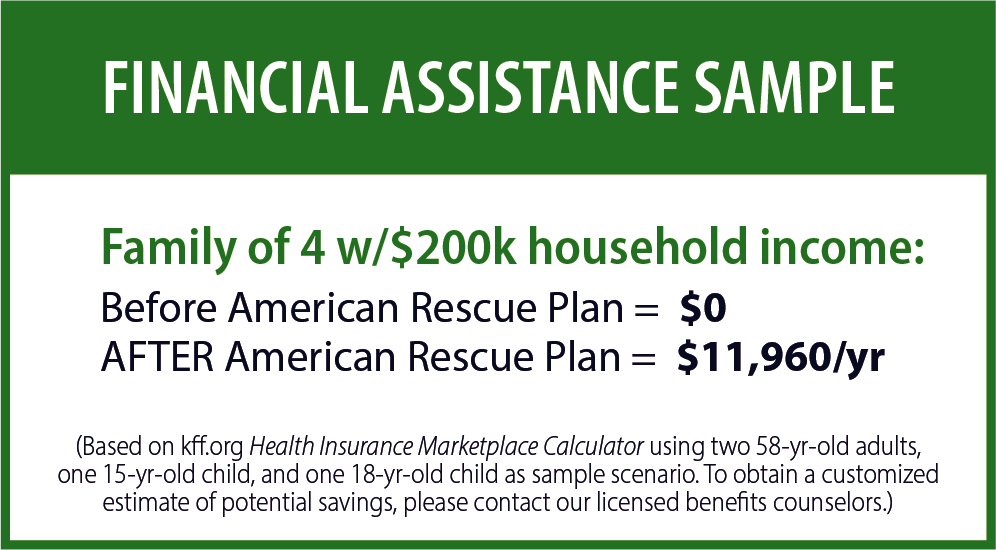

ARP subsidies have dramatically improved access and affordability for Americans. The qualification criteria have been expanded to include higher-income households, including those making more than 400% of the federal poverty line. ARP also provides increased subsidies for those who had already qualified, and households with income below 150% of the federal poverty level will benefit from eliminated premiums and decreased deductibles.

If you have not inquired about ARP savings since the income thresholds were loosened, schedule a free 15-minute appointment with a licensed benefits counselor. Remember: enrollment ends August 15.

47% of Americans experienced some type of financial identity theft in 2020 alone, according to a report by the Aite Group. A wallet typically contains most, if not all, of the information criminals need to exploit your identity – by opening bank accounts, taking out loans, and making fraudulent charges in your name.

If your wallet happens to be stolen or lost, it’s critical that you take steps to protect your identity.

Before taking the drastic measure of closing accounts and reordering documents you should make sure that your wallet really is lost or stolen. Try retracing your steps thoroughly and checking places you recently visited – such as where you made your last purchase. You may end up saving yourself time, money, and a headache.

If you’ve established that your wallet is definitely lost or stolen, the first thing you should do is call each of your banks / financial institutions to inform them. They will deactivate your card and mail you a replacement, which normally arrives within a week.

The sooner you can deactivate your card, the better. Doing so can help decrease the amount of unauthorized charges that you could be held legally responsible for. (These policies vary, so check with your bank.)

The next step involves notifying one of the three national credit bureaus – Equifax, TransUnion, and Experian. The credit bureau will “freeze” your credit, which blocks criminals from trying to open any new lines of credit or accounts in your name. Do this quickly. If a thief does serious damage before you’re able to freeze your credit, it can potentially take years to recover from.

While it probably won’t help get your wallet back, a police report provides you with official documentation of the theft. This can be helpful if you end up filing a complaint with the Federal Trade Commission, or applying for a new driver’s license or social security card.

Now that the wheels are in motion with the critical items mentioned above – you can shift your focus to replacing the other items that were in your wallet. Start by doing an inventory of the contents (driver’s license, insurance cards, loyalty cards, etc.), and then contact each provider for details on their replacement process.

Restoring your identity and credit after losing a wallet can end up being a lengthy and costly process. For peace of mind consider securing an identity theft protection plan. These plans provide suspicious financial activity monitoring, dark web tracking, data breach notifications, and other services that help safeguard your identity and credit.

As a benefit of your membership, you can receive special pricing on an identity theft protection plan. Visit the ID theft protection page today to enroll.

It is estimated that roughly 70 percent of people turning 65 will need some type of long-term care service in their lifetime. But needing long-term care is not something strictly determined by age. Instead, the threshold for determining whether a person needs long-term care services is determined by their ability to manage activities of daily living (otherwise known as ADLs).

ADLs are defined as basic activities deemed necessary to carry on living at home independently. They are performed on an everyday basis and typically revolve around basic personal needs.

If you are debating whether a loved one is capable of sufficient self-care, assess their ability to perform the following five ADLs:

Without being able to perform these daily functions, a loved one’s quality of life typically declines very rapidly. This can lead to infections, starvation, and even being stranded in one’s own home. Despite common beliefs, a spouse or child may be unable to care for an elder or disabled loved one when the time of need arrives. That’s where long-term care comes along.

The list of ADLs can help determine the need for long-term care and the amount of assistance required. Each state assistance program uses different assessments, but assistance is usually recommended when someone is unable to perform two or more of the ADLs listed above.

The cost of long-term care facilities grew 6.15% following the COVID-19 pandemic, with the median cost settling at $51,600/year. Whether you’re looking out for a loved one or thinking of establishing a safety net for your future self – a long-term care insurance policy can help.

Social distancing guidelines and safer-at-home recommendations that resulted from the COVID-19 pandemic have forced families, businesses, governments, schools, and healthcare systems to figure out entirely new ways to operate. Ingenuity, innovation, and new technologies have allowed many to adapt to this new way of life.

One of these breakthroughs has been the emergence of telehealth / telemedicine. Usage soared in the last year, with consultations rising by 89%, according to First Stop Health. Many are still unaware of the benefits of this new service, so let’s review a few of them.

Flus and viruses normally travel from person to person through respiratory droplets, and the COVID-19 virus is no different. Researchers consider COVID-19 to be a highly contagious virus, with each infected individual possibly infecting up to two or three additional people. Being able to visit a doctor from the comfort of your home eliminates contact with other people and crowded waiting rooms filled with sick patients. This can be especially helpful for those with pre-existing conditions, as they may face more severe complications.

The convenience of being able to talk to a board-certified physician from the comfort of your home means less time spent in a waiting room and less time out of your workplace. This is especially helpful if the medical specialist happens to be located far away from your home. Most virtual telehealth visits last only 17 minutes, compared to in-person appointments, which average two hours (including travel time).

One of the best things about telehealth is its affordability. With many employers expanding their benefits package to include telemedicine, a virtual session can end up being more affordable than a trip to an urgent care center.

Telehealth can allow you to receive medical treatment at a moment’s notice – 24 hours a day, 7 days a week. Whether that is on a lunch break from the confines of your car, or in the middle of the night when your child comes down with a fever, a medical professional will be available to assist you.

Learn more about the telehealth services available to members, with plans starting at just $9/month for the whole family.

Just over a year ago we never suspected that wearing a face mask in public and social distancing would become part of our new normal. Concerts, festivals, and sporting events have been rescheduled or canceled, countless businesses have been forced to permanently close, and even Disney World temporarily shut their doors to the public.

With health and safety becoming a major focus this past year for everyone, how can employers prepare for changes to the group health and benefits planning process?

To accurately plan your health benefits going forward, you’ll want to begin by identifying any trends or changes from this year. Here are a few questions you should be considering:

Our team can offer expert advice, creative solutions, telemedicine, and best-in-class digital capabilities so you never need to collect paper enrollment forms again.

While plenty of data exists for viruses that have been around for decades, there just isn’t a lot of solid information on COVID-19 costs yet – which can make planning for the next year difficult. How long will the virus last? Can normal activities be resumed after a vaccine is received? What kind of long-term health complications may occur from the virus? These are the kinds of questions that the medical, healthcare, and business communities don’t have the final answers to just yet.

Need help determining which group health options may work best for your organization? Our licensed benefits counselors are available to answer questions regarding your group health benefits, and may even be able to help you save some money. Learn more about our employer group solutions and what our team can do for you.

Millions of Americans have had to adjust to working remotely due to the COVID-19 pandemic. While some offices and businesses have reopened their doors, there are many others that are still enforcing remote working conditions. In addition to all the technological changes that has led to, it also means that you and your family have had to adjust to significant changes to your routines—including those involving your pet.

Pet owners should spend 1-2 hours a day with their cat or dog. But when working from home, you can expect that amount of time to increase. It’s important to develop a new sense of normal with your pet, without them expecting your complete attention during working hours.

So, what can you do to make sure you’re still able to be productive while working from home?

When working from home, it may be tempting to sleep in without having to worry about the commute, but that extra time in the morning may be better spent with your pet. Providing food and playtime in the morning will help tire your pet and leave you with more time to work uninterrupted.

Have an upcoming call or task that will require your undivided attention and concentration? Be sure to attend to your pet’s needs in advance. Potty breaks, food and water, and toys can help keep your pet distracted and entertained without you (at least for a while).

Has your coworker been good? Reinforce their good behavior with treats, their favorite toy, or some one-on-one playtime. As with any kind of training, it’s important to reward good behavior and work to improve the bad.

As of August 2020, only 20 dogs and cats have been positively diagnosed with COVD-19 in the United States. So while it is possible to pass the virus on to your pet, it appears to be far less contagious to animals than it is to humans.

If your pet ever does get sick, the cost of treatments and medications can put an unnecessary strain on your finances. To help offset these costs, we have teamed up with Nationwide to offer discounts on pet insurance to members. To learn more, or to request a quote, please visit the pet insurance page today.

On Thursday, January 28, 2021, President Biden announced plans to reopen the federal health insurance markets for a nation-wide Special Enrollment Period. This action is being taken in response to the massive economic effects of the COVID-19 pandemic which has resulted in some of the highest unemployment rates in decades.

The 2021 Special Enrollment Period will begin on February 15 and run through May 15, 2021. Coverage effective dates for those who enroll during this time will begin on the first day of the month following an enrollment date. (For example, an enrollment date of March 4 will have an effective date of April 1.)

Yes. The annual Open Enrollment Period will run from November 1 through December 15. Individuals who enroll during this time will have a January 1, 2022 coverage effective date.

No. If you are currently enrolled in health insurance coverage, you do not need to enroll again. However, if you are interested in changing your coverage, this is your chance to secure ACA-compliant health insurance outside of the annual Open Enrollment Period. Just keep in mind that if you decide to change your plan, your deductible and out-of-pocket maximum will reset based on your new coverage details.

No. Even though this is being called a 2021 COVID-19 Special Enrollment Period, you do not need to have experienced COVID-19, or even a Qualifying Life Event to enroll in (or change) coverage.

To learn more or to begin shopping plans, visit our Health Insurance page or schedule an appointment to speak with a licensed benefits counselor.

Over the last year we’ve spent a lot of time focusing on staying healthy. We’ve washed our hands to the tune of happy birthday, worn face masks in public, and stayed home instead of going out. But when was the last time we focused on our oral health? Science has shown that problems that begin in our mouths can have an impact on the rest of our bodies.

But aside from daily flossing and brushing, taking care of our teeth and gums can be expensive. Dental insurance can help you cover the cost of keeping your teeth and gums as healthy as possible.

So, what else can dental insurance help you cover?

Dental pain is often a double-edged sword. There’s the physical pain – and for those without insurance – the pain of a hollowed-out wallet.

If you find yourself experiencing tooth pain, there’s a chance it is the result of something left unattended for too long and now requires major restorative work.

Most dental insurance plans offer deep savings on major restorative dental work and cover all or most preventative care which can help you avoid dental emergencies in the future.

The American Dental Association recommends that you visit a dentist at least once a year for an exam and cleaning.

You may not always know what dangers could be just around the corner for you and your pearly whites—but a dentist can. Minor issues can lead to bigger and more costly ones down the road.

But the good news is that costly and painful dental problems can often be avoided with regular visits to a dentist and maintaining an oral hygiene routine at home.

According to the Pennsylvania Dental Association, roughly 4 million people in the U.S. wear braces. But perfectly straight teeth can come at a hefty price.

The cost of dental braces can range anywhere between $3,000 and $10,000 (not including any other orthodontia services that may be required to help you achieve perfectly straight teeth).

And while not all dental insurance plans cover orthodontia, the ones that do can save you thousands, making you or your children’s path to a great smile a lot less painful.

Dental insurance can help you and your family maintain your smiles for years to come. Tackle dental emergencies knowing you’re covered, address concerns before they become problems, and prevent future issues while saving on your out-of-pocket costs.

Visit our dental insurance page to see rates, review plan details, and enroll today.