Deciphering Dental Insurance Terminology

Navigating the world of dental insurance can sometimes feel like deciphering a foreign language. With a myriad of terms and verbiage to understand, it’s no wonder many people find themselves confused when trying to make sense of their coverage.

By gaining a better understanding of key terms, you can empower yourself to make more informed decisions about your dental health and insurance coverage. In this blog, we’ll break down some of the most important terms you should know when it comes to dental insurance.

Key Terms Used in Dental Insurance

- Premium: The amount you pay to your dental insurance company or third-party administrator, usually on a monthly or yearly basis.

- Deductible: This is the amount you must pay out of pocket before your dental insurance kicks in. For example, if your deductible is $500, you’ll need to pay $500 for covered services before your insurance starts to cover any costs.

- Covered Services: This refers to the specific treatments, procedures, and preventive care that are included in your insurance plan. These services are typically outlined in your policy and may vary depending on the type of plan you have. When you receive covered services, your insurance provider will pay a portion of the cost, as specified in your plan, while you may be responsible for copayments, coinsurance, or any amounts not covered by your plan.

- Copay: A copayment, or copay, is a fixed amount you pay for a covered service, such as a dental visit or procedure. Copays can vary depending on the service provided.

- Coinsurance: Coinsurance is the percentage of costs you share with your insurance company after you’ve met your deductible. For example, if your coinsurance is 20%, you’ll pay 20% of the covered expenses, and your insurance will cover the remaining 80%.

- Annual Maximum: This is the maximum amount your insurance will pay for covered services within a plan year. Once you reach this limit, you’ll be responsible for paying any additional costs out of pocket.

- Lifetime Maximum: Similar to the annual maximum, the lifetime maximum is the total amount your insurance will pay for covered services over the lifetime of your plan.

- Coordination of Benefits: If you have more than one dental insurance plan, coordination of benefits determines which plan pays first and how much the secondary plan will cover.

- Exclusions: These are services or treatments that your dental insurance plan does not cover. It’s important to review your plan’s exclusions carefully to understand what services you may need to pay for out of pocket.

- Maximum Plan Allowance: This is the maximum amount your insurance will pay for a specific covered service. If your dentist charges more than the maximum plan allowance, you may be responsible for paying the difference.

- Waiting Period: Some dental insurance plans have waiting periods before certain services are covered. It’s essential to understand any waiting periods associated with your plan to avoid unexpected costs.

- Preauthorization: The process of getting approval from the dental insurance company before receiving certain dental treatments or procedures, often for more expensive or specialized treatments.

- In-network: Dentists who have agreed to accept negotiated rates from the insurance company for covered services. Using in-network providers usually results in lower out-of-pocket costs for the insured individual.

- Out-of-network: Dentists who have not agreed to accept negotiated rates from the insurance company. Using out-of-network providers may result in higher out-of-pocket costs for the insured individual.

Navigating Deductibles, Copayments, and Coinsurance in Dental Insurance Plans

Understanding how deductibles, copayments, and coinsurance work can help you manage your dental expenses more effectively. Here are some tips for navigating these aspects of dental insurance:

- Understand how deductibles work. Take note of your plan’s deductible and plan your dental care accordingly. Consider scheduling routine check-ups and cleanings early in the year to help meet your deductible sooner.

- Manage copayments and coinsurance for various services. Familiarize yourself with the copayment amounts for different services covered by your plan. Knowing what you’ll need to pay out of pocket for each service can help you budget accordingly.

- Minimize out-of-pocket expenses. Take advantage of preventive services covered by your plan, such as routine cleanings and check-ups, to maintain good oral health and avoid costly treatments down the road. Additionally, consider using in-network providers as it will typically result in lower out-of-pocket costs.

Conclusion

Understanding dental insurance terminology is essential for making informed decisions about your coverage and managing your dental expenses effectively. By familiarizing yourself with key terms like deductibles, copayments, and coinsurance, you can navigate the complexities of dental insurance with confidence. Remember to review your plan’s coverage details carefully. Empower yourself with knowledge and take control of your dental health and insurance coverage today.

Visit the dental & vision insurance page to see current rates, review plan details, and enroll in minutes.

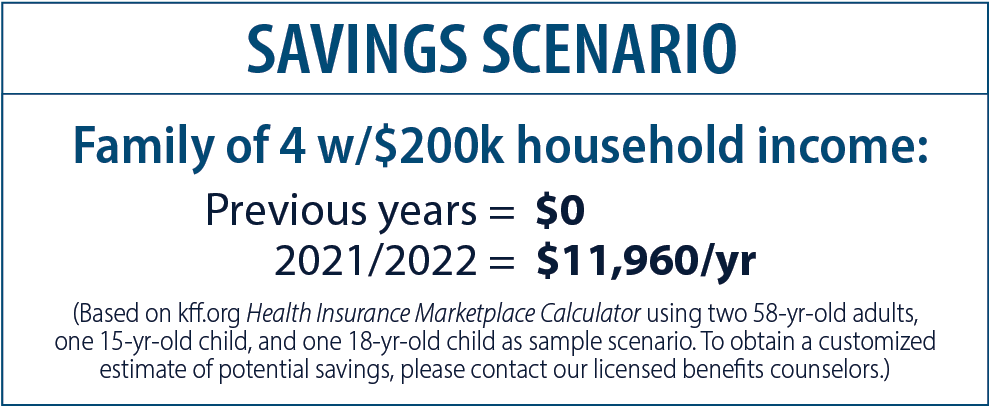

If you need assistance finding the perfect plan for you and your family, or wish to see if you qualify for an expanded subsidy, please

If you need assistance finding the perfect plan for you and your family, or wish to see if you qualify for an expanded subsidy, please