WEBINAR REPLAY: 2024 Open Enrollment Info

If you missed our 2024 Individual Health Insurance Open Enrollment webinar a video replay is available below.

If you missed our 2024 Individual Health Insurance Open Enrollment webinar a video replay is available below.

Over the next three years, more people in the US will turn age 65 than any other time in the history of the country. This marks a major milestone in most people’s lives as they are faced with an extremely important healthcare decision.

As people approach their 65th birthday, most are confronted with the same issues:

There are plenty of Medicare products on the market; however, what most people are looking for is an understanding of how Medicare works and how it applies to them. Let’s take a look.

Medicare is broken down into four parts: A, B, C, and D, with parts A and B commonly referred to as “Original Medicare”. (The primary reason many people favor Original Medicare is due to the open access of care. There are no networks, so this coverage is accepted anywhere in the country by any provider or facility that accepts Medicare. If you move, your coverage goes with you.)

This covers a portion of the costs for hospitalization and skilled nursing care. It includes deductibles and co-insurance costs to the insured. Most people receive Part A at no cost if they have been employed at least 40 quarters during their lifetime. You must make application with Social Security to receive Part A.

This is the medical insurance portion of Medicare, which covers physician services and other ancillary healthcare benefits. It also carries a $226 annual deductible, and a 20% co-insurance with no cap. Part B has a monthly cost of $164.90, with higher premiums for higher income earners. You must also apply for Part B through Social Security.

Also known as “Medicare Advantage”, this is another way to get Part A and Part B coverage. These plans are offered and managed by private insurance companies. These “bundled” plans include Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) and usually Part D (Drug Coverage). There is no cost for many of these plans, although the Medicare Part B premium must still be paid. They often offer coverage for benefits not covered by Original Medicare such as vision, dental, hearing and health club memberships.

While these plans offer a zero upfront cost along with additional benefits, care is limited to the providers within the carrier’s network. They operate much like group or individual coverages for those under 65, with HMO and PPO options. Generally, an HMO offers a lower out of pocket cost along with a smaller network, while a PPO offers a larger network with a higher out of pocket costs. If you move out of the coverage area or the carrier discontinues the plan, new coverage will need to be obtained.

This is a prescription plan that helps pay for the cost of prescription drugs. Medicare.gov provides a very useful tool to determine the most cost-efficient plan, based on your current medications. This is separate coverage from Medicare and while not required, there are substantial penalties for signing up after the initial enrollment period.

As you approach age 65, find an advisor who can give you a clear picture of how Medicare works for your individual situation. An understanding of these basics should precede any discussion relating to products and will make your decision-making process much easier. Visit the Medicare Solutions page to connect with a specialist.

Astigmatism may sound intimidating, but it’s more common than you’d think. According to the American Academy of Ophthalmology, approximately one in three people experience astigmatism. It is often misconstrued as an eye disease or an eye health problem, but is, in fact, an eye focusing condition that can distort or blur your vision.

The normal curvature of the cornea (the outer portion of the eye), and the lens (the inner part of the eye) are smooth and parallel. The typical shape of the eye is often compared to a basketball. People with astigmatism have a cornea and a lens with an irregularly curved shape. The irregular shape is often compared to a football.

Similar to nearsightedness and farsightedness, astigmatism is a refractive error. When light enters your eye, it is unevenly distributed on the retina, which causes blurred vision.

Astigmatism can occur in both adults and children. Your risk of being affected by astigmatism is higher if you have any of the following:

Symptoms may vary from person to person. Some people may not experience any symptoms, whereas others may experience one or more of the symptoms listed below:

An optometrist will diagnose astigmatism through a dilated eye examination, similar to the eye examination used to diagnose nearsightedness and farsightedness. A keratometer is then used to measure the curvature of your cornea by calculating how much light reflects off of your cornea. This will determine the extent of your astigmatism. If your optometrist deems it necessary, they will test how you respond to light as your eyes focus. This part of the exam is simple, painless, and will help determine your best treatment plan.

If your astigmatism is mild, it may not require any treatment. However, depending on the result of your diagnosis, your optometrist will choose the best treatment option for you. Below is a partial list of common treatments:

Contact your professional optometrist if you believe you may have any symptoms pointing to astigmatism.

Did you know that you can get vision insurance as an add-on when you’re enrolling in one of our MetLife dental insurance plans? View plan details and enroll today.

If you missed our 2023 Individual Health Insurance Open Enrollment webinar a video replay is available below.

According to a recent study done by LIMRA’s Life Insurance Barometer, “there are 102 million uninsured and underinsured Americans who know they need (or need more) life insurance coverage” and yet, only 52 percent actually have it. But then the question becomes, what form of life insurance is right for you and your family and could it be term life insurance?

Life insurance, by nature, has been designed to act as a financial safety net for your family in the event of your death. But when researching the differences between whole and term life insurance policies, the options can seem confusing.

When most people think about life insurance, they are more than likely thinking about whole life insurance. Unlike term life, whole (or permanent) life insurance is for your entire life span or up to age 100 in some cases, whereas term life is designed to provide coverage for a pre-specified period of time often ranging anywhere from 1 to forty years.

Cost is another key difference between the two policies. While most whole life insurance policies tend to have a higher premium from the start, many times your rate will not go up. Term life insurance, on the other hand, determines premiums based on the age of the policyholder, therefore a policyholder in their forties, for example, would have a higher premium than an individual in their twenties.

Whole life insurance also accumulates a cash value over time that grows at a guaranteed rate and is tax deferred. As the policyholder, you are able to borrow against the policy but you must be ready to pay the money back with interest. This is a feature of whole life insurance that term life does not offer.

While term life insurance might not be right for everyone, it may end up being a better fit for you, your budget, and your family when compared to whole life insurance.

Due to the fact that term life policies tend to be less costly overall (especially for those in younger age brackets), they might make more sense for new or growing families. Many who opt for a term life policy are entry to mid-level in their careers and may not have the kind of saving habits or capabilities to cover their family or debts in the event of an early death.

With a term life policy, your payout benefits could give your family and dependents the financial support they would need to not only pay for funeral expenses, but also supplement the loss of your income, and help put your children through college in the event of your death.

As term life policies generally provide you with coverage for a pre-specified period of time, once your term of coverage is over, the policyholder would then need to renew their current policy at higher rates or seek out a new life insurance policy should they wish to maintain their coverage.

Ultimately the decision between term life insurance and whole life insurance is a personal one and should be discussed with your family, agent, or both. When you truly examine your finances and current situation, you may find that a term life insurance policy would be a better fit for you in the long run and save you money in the short-term.

Are you ready to learn more about the Term Life policies that are available to you? Visit our term life insurance page for more information, or contact us to speak with a benefits counselor who can assist you.

If you’re on the cusp of turning 65, you may be feeling overwhelmed with the Medicare system right now. Plans, parts, options, supplements, enrollment periods, deadlines, regulations – it’s a lot to take in.

To help make sense of it all we’ve compiled a list of basic Medicare terms and names that you’ll need to know before making your selections.

This will help recipients cover inpatient hospital care, skilled nursing facility care, hospice care, and home health care.

This helps cover medical services from doctors and other health care providers, outpatient care, additional home health care, and medical equipment such as wheelchairs, walkers, hospital beds, etc. It will also help cover many preventive services (screenings, vaccines, and routine exams).

Medicare Advantage Plans are offered by private companies and provide all of the Part A and B benefits, with the exception of certain aspects of clinical trials (which are covered by Original Medicare). Medicare Advantage Plans include:

These plans are sold by private insurance companies that follow rules set by Medicare, and they help enrollees cover the cost of prescription drugs and many recommended vaccines.

Original Medicare includes Medicare Parts A and B and can be used to visit any doctor or hospital that accepts Medicare. It does not include Part D and will not cover any out-of-pocket costs associated with Medicare (such as the 20% coinsurance).

Medicare health plans are offered by private companies that contract with Medicare to provide Part A and B benefits. They include Medicare Advantage Plans, Medicare Cost Plans, Demonstration/Pilot Programs, and Programs of All-Inclusive Care for the Elderly (PACE). PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits.

This is how Original Medicare tracks your use of hospital and skilled nursing facility services. A benefit period begins when you’re admitted to a hospital or skilled nursing facility as an inpatient, and ends when you haven’t received any care for 60 consecutive days. If you are admitted to a hospital or a skilled nursing facility after one benefit period has ended, a new benefit period will begin. There’s no limit to the number of benefit periods you can experience but you will still be expected to pay the inpatient hospital deductible for each benefit period.

Referring to Original Medicare, this is the amount a doctor or supplier agrees to be paid for services and may be less than their non-Medicare rate. Of this agreed-upon amount, Medicare will pay part of it and you will be expected to pay the difference out-of-pocket.

Medicaid is a joint federal and state program that helps enrollees who have limited income pay for medical costs.

Also referred to as Medicare Supplement Insurance, Medigap is sold by private insurance companies to help Medicare enrollees fill the “gaps” in their Medicare coverage.

Whether you’re turning 65, already have coverage, or helping a family member with their decision, getting the right Medicare advice is critical.

As a benefit of your membership, you — as well as your spouse and parents — have access to a team of Medicare Specialists. These experts can answer your questions, review all your options, and help you navigate the process so that you can make the best decision based on your specific circumstances.

[vcex_divider_dots color=”#49AE56″ margin_top=”0″ margin_bottom=”20″]

Visit our Medicare Solutions page to connect with a Medicare Specialist.

Lifelong oral health problems often begin in childhood, which is why it’s important to develop good oral health habits when your child is young. While there are many different types of dental issues, here are some of the most problematic to look out for in children:

This is the most common dental problem found in children. Baby teeth are especially prone to decay because they’re softer and more fragile than permanent teeth. Tooth decay occurs when acids and bacteria break down enamel and penetrate deeper layers in the tooth. This penetration leads to a cavity, which can then cause pain, infection, and if left untreated — an abscess formation.

According to a 2019 report from the CDC, 80% of children in the U.S. begin brushing their teeth later than dentists recommend. To prevent this problem, begin a twice-daily brushing regimen (using fluoride toothpaste) with your child as soon as their first tooth appears. It’s also important for parents to teach their kids to eat a balanced diet and avoid excessive sugary drinks and candy.

Gum disease, also referred to as gingivitis or periodontal disease, is caused by bacterial infections and can lead to bleeding gums and bad breath. Children who develop gum disease may need antibiotics or other medications. The best way to prevent gum disease is with regular visits to the dentist every six months.

From the playground to the soccer field to backyard hide-and-seek, children are prone to accidents — and are therefore more susceptible to breaking or chipping their teeth. A fractured tooth can be extremely painful, so contact your dentist right away if this happens to your child.

Surprisingly, teeth grinding often begins during childhood or adolescence. If you are seeing patterns of headaches, neck pains, jaw pain, or earaches in your child, they could unknowingly be grinding their teeth. If left untreated this can cause long-term damage to enamel and dentin, so let your child’s dentist know if any of these symptoms come up.

Thumb sucking is one of the most common behaviors associated with early childhood. Excessive thumb sucking can have lifelong effects such as improper jaw alignment, overbites, crossbites, crowding of the teeth, malocclusion, and speech difficulties. If you notice your toddler excessively sucking their thumb, attempt to change their behavior by replacing it with pacifiers or finger foods such as carrots, celery, or apple slices (when they are old enough). If your child continues thumb sucking past age three, consult your dentist.

Some kids may experience extreme fear or anxiety over going to the dentist. This is normal but if it becomes too much, there are ways to help them overcome their fears. Scheduling regular checkups with your child’s dentist from a young age can help normalize the experience and ensure that any dental problems are caught and taken care of early on. It may also help to talk to them about oral health at home and set a good example by taking good care of your own oral hygiene.

Ready to take the first step on your family’s road to great oral health? Members have access to group rates on PPO dental plans! Visit our dental page to view plan details and enroll today.

More than two years in, and companies around the world are still learning how to navigate the COVID-19 pandemic. In addition to the ongoing threat of new virus variants, employers now face another unforeseen reaction to the pandemic that the media has dubbed as The Great Resignation.

According to the most recent report from the Bureau of Labor Statistics, U.S. workers quit their job in near-record numbers in November of 2021, and employers followed up by posting 10.6 million job openings.

The pandemic has forced millions of individuals and families to re-evaluate their priorities, and a startling number of them have yet to return to the workforce. So how can businesses hang on to their existing staff while attracting new talent?

In a word, benefits. The employee benefits landscape is changing, fast. For starters, a base salary, alone, is no longer enough to stay competitive. Companies leading the way have added perks such as flexible working arrangements, increased paid time off, mental health support, parental leave, and even education assistance. And if the pandemic has taught us anything, it’s that taking care of one’s health has never been more important. Businesses embracing this are presenting their employees with more group health insurance options than ever before. For instance, some groups are electing to increase their employer contribution amounts toward health insurance plans from 50% to 100% and are even offering richer benefit plans. And what were once voluntary ancillary group benefits, such as dental and telehealth, are now part of many companies’ standard offering.

Your employees invest a lot into your business, and you invest the time and money to train them to be successful in their positions. Over time, you’ve come to value and rely on their consistency, dedication, and hard work. Make sure that they value you just as much.

Our team of licensed benefits counselors can help you curate an employee benefits package that stands out from the rest. Visit our group health & employee benefits page today to schedule an appointment or request a free quote.

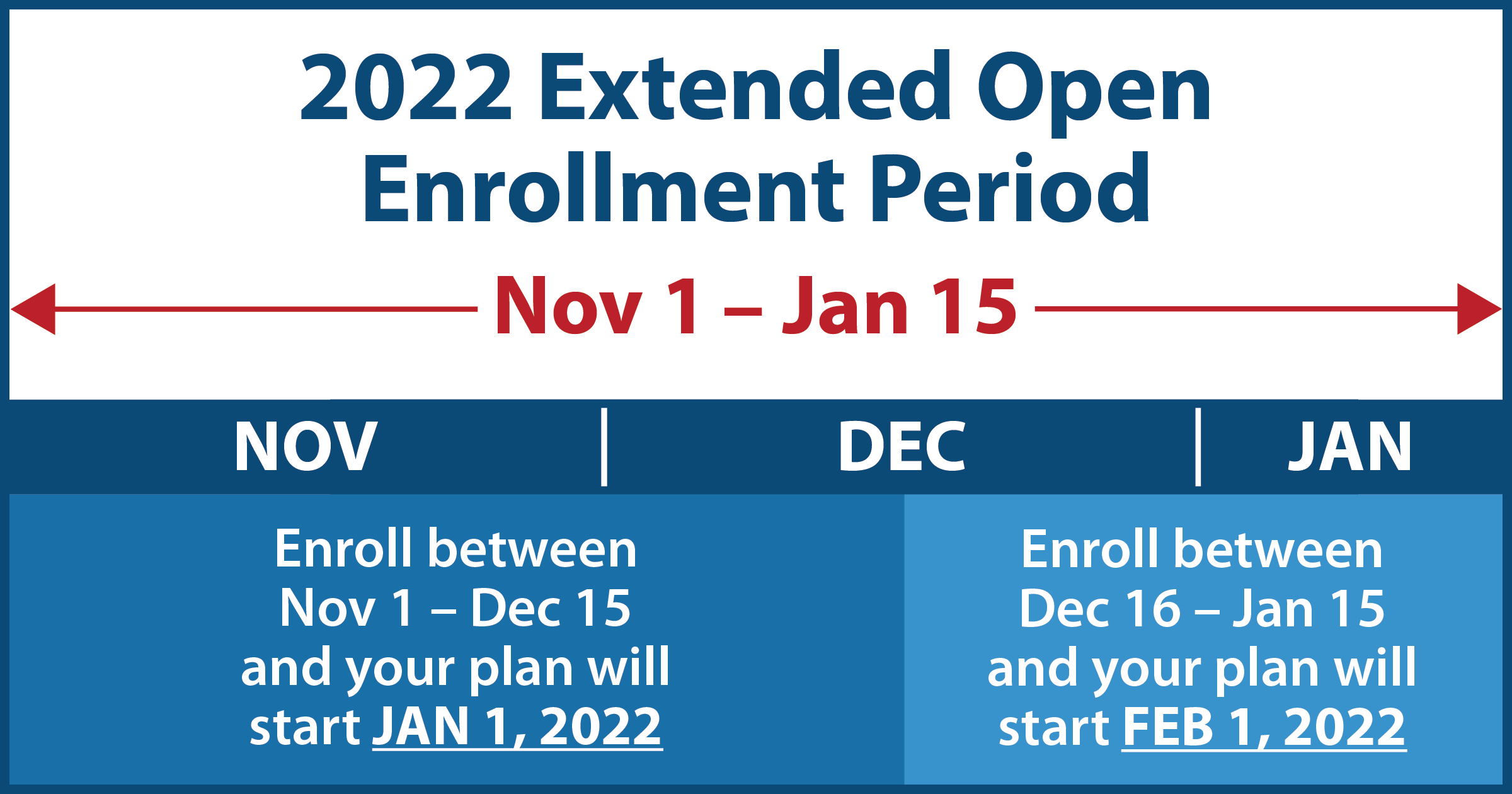

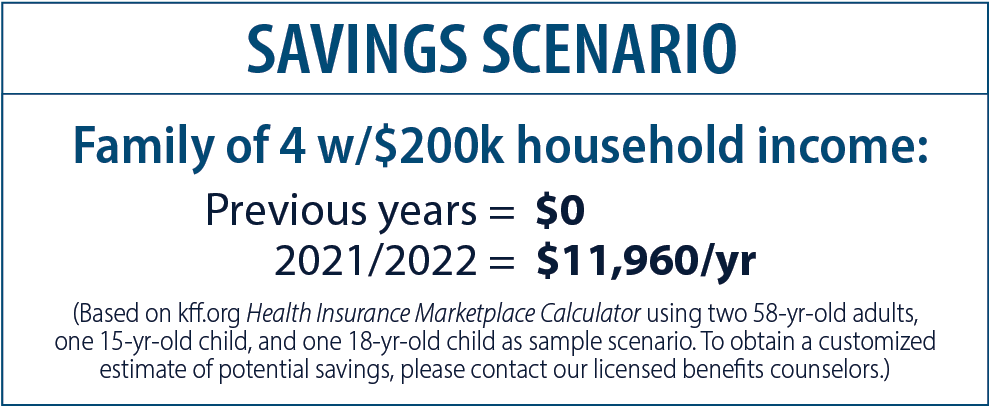

The 2022 Open Enrollment period began on November 1 and will end on January 15, 2022. Now is the time to shop for individual health insurance plans from industry-leading carriers. This year, millions more Americans are qualifying for health insurance subsidies and tax credits — including higher-income families who would not have been eligible in previous years.

If you need assistance finding the perfect plan for you and your family, or wish to see if you qualify for an expanded subsidy, please schedule a free 15-minute appointment with a licensed benefits counselor.

If you need assistance finding the perfect plan for you and your family, or wish to see if you qualify for an expanded subsidy, please schedule a free 15-minute appointment with a licensed benefits counselor.

NOTE: If you need coverage with an effective date of Jan 1, 2022, you must enroll by Dec 15, 2021.

The annual Open Enrollment period for individual health insurance is underway. Now is the time to shop for individual health insurance plans from industry-leading carriers.

This year, millions more Americans are qualifying for health insurance subsidies and tax credits — including higher-income families who would not have been eligible in previous years. If you need assistance finding the perfect plan for you and your family, or wish to see if you qualify for an expanded subsidy, please schedule a free 15-minute appointment with a licensed benefits counselor.

NOTE: If you need coverage with an effective date of Jan 1, 2022, you must enroll by Dec 15, 2021.